-

Hey, guest user. Hope you're enjoying NeoGAF! Have you considered registering for an account? Come join us and add your take to the daily discourse.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock-Age: Stocks, Options and Dividends oh my!

- Thread starter koam

- Start date

CrankyJay™

Member

So tip trade of the week. If you were like me you bought re opening stocks (not a large percentage of your portoflio), mostly mall and clothing stocks have been rallying for good cause.

Up 73.0% on my clothes and malls stock combined (will be cashing out soon). EXPR for example has been on a good run (still not a good company to invest over the long term)

He's climbin up your nostrils

He's snatchin' your people up

Hide yo' kids, hide yo' wife,

Hide yo' kids, hide yo' wife,

Hide yo' kids, hide yo' wife,

And sell yo' stocks cuz delta variant will take your life

StreetsofBeige

Gold Member

Inflation data shows core inflation at 3.6%. I too believe inflation to be sticky around 3.5% - 5.0% range. I expect it to get worse around Christmas and Winter.

I am now FULLY removed from the short term transitory camp. No way inflation will hit 2.0% y o.y

ManOfOne,

Based on the inflation info and what your sentiment is, what sectors or stocks you looking at going forward. I just sold a decent winner today (+15-20% in less than 3 weeks) and now got roughly 40% cash sitting there.

I know you said you got a lot of cash on the sides. Perhaps you going to wait it out and dive back in later?

Last edited:

HoodWinked

Member

what the fuck man nike doing some meme stock shit. yup this is where people's stim checks went, luxury apparel.

Last edited:

godhandiscen

There are millions of whiny 5-year olds on Earth, and I AM THEIR KING.

WSB doesn’t feel organic anymore.what the fuck man nike doing some meme stock shit. yup this is where people's stim checks went, luxury apparel.

The professional stock manipulators must have cracked the code for herding Reddit masses into pumping their desired positions.

ManofOne

Plus Member

ManOfOne,

Based on the inflation info and what your sentiment is, what sectors or stocks you looking at going forward. I just sold a decent winner today (+15-20% in less than 3 weeks) and now got roughly 40% cash sitting there.

I know you said you got a lot of cash on the sides. Perhaps you going to wait it out and dive back in later?

I personally don't think any sector is safe but i'm long on "productivity" stocks

"Productivity Portfolio should include companies that produce labor-augmenting technologies, including semiconductors, robots, 5G communication, 3D manufacturing, and cloud and quantum computing.

Investors should also look for nontech companies that are investing in technology. Yardeni says that’s especially happening across the consumer discretionary, financials, industrials, and healthcare sectors. "

And long on Financials as they are investing in tech heavily.

Last edited:

ManofOne

Plus Member

what the fuck man nike doing some meme stock shit. yup this is where people's stim checks went, luxury apparel.

Yep

I dumped my BABA earlier this week one afternoon. It's been down since Fall and has been pretty stagnate. Plus I've never really liked supporting a company tied to the Chinese government. I've been holding off on dropping it but finally did it. Of course the next morning it shoots up and has done that every day since. I bought it cheap a few years ago so I still made a decent amount off of it. Oh well.

KingdomHeartsFan

Member

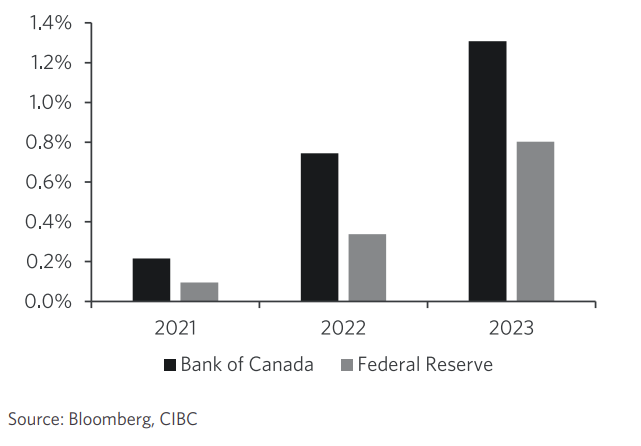

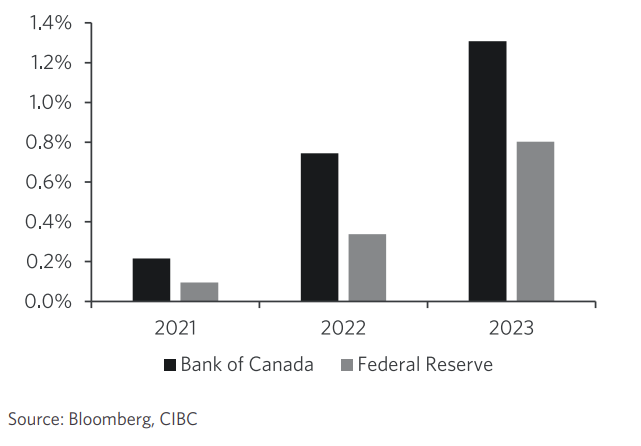

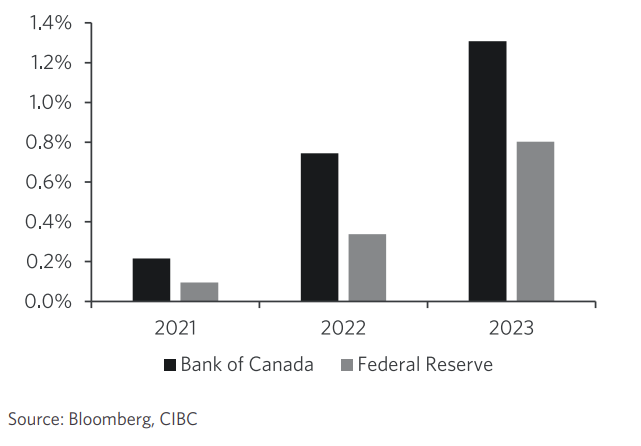

So apparently Canada is raising rates faster and by more than the fed which is surprising to me since inflation is more in America than it is in Canada and Canada has already started tapering.

I've been paying so much attention to what the fed is doing I know more about the US than I do about my own country lol.

I've been paying so much attention to what the fed is doing I know more about the US than I do about my own country lol.

PSYGN

Member

Probably the mindset of "I didn't get to really shop last year so let me by 2x the amount of clothes to make up for that"

ManofOne

Plus Member

So apparently Canada is raising rates faster and by more than the fed which is surprising to me since inflation is more in America than it is in Canada and Canada has already started tapering.

I've been paying so much attention to what the fed is doing I know more about the US than I do about my own country lol.

Canada doesn't have the reserve currency status like the states so this is probably a FX issue.

godhandiscen

There are millions of whiny 5-year olds on Earth, and I AM THEIR KING.

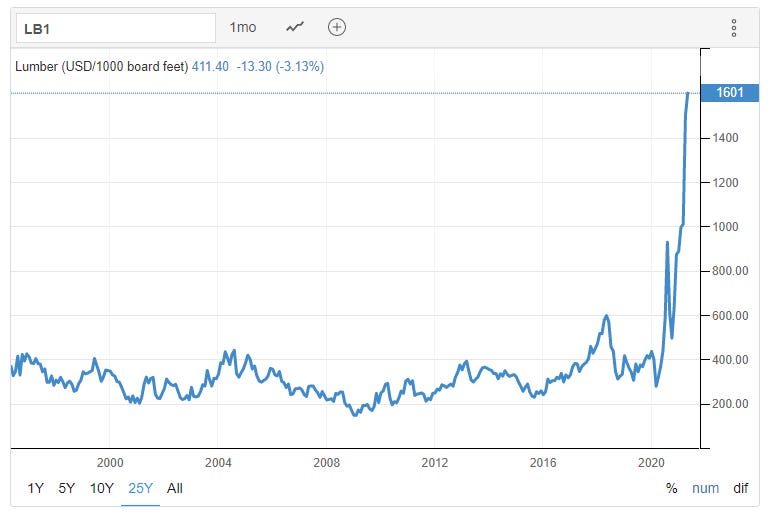

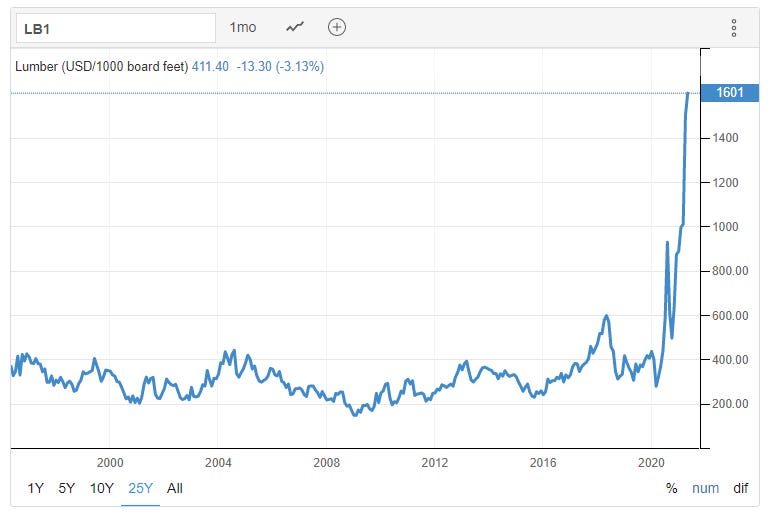

Good article on the conditions affecting wood prices for those interested.

The price of wood is a major factor in the price of new housing development. It sounds to me like house prices will just continue going up.

The statistic is percent change, not net spend. Considering people stopped buying clothes due to lockdowns, it shouldn't be a surprise that even a subtle positive change in the market makes up for a massive movement.

With the acceptance of telecommuting, I see the market for clothes decreasing long term. I am still convinced this is a false signal to boost positions in these shrinking industries.

The price of wood is a major factor in the price of new housing development. It sounds to me like house prices will just continue going up.

Probably the mindset of "I didn't get to really shop last year so let me by 2x the amount of clothes to make up for that"

The statistic is percent change, not net spend. Considering people stopped buying clothes due to lockdowns, it shouldn't be a surprise that even a subtle positive change in the market makes up for a massive movement.

With the acceptance of telecommuting, I see the market for clothes decreasing long term. I am still convinced this is a false signal to boost positions in these shrinking industries.

Last edited:

HawksWinStanley

Member

I know you're following the meme stocks but what's the general consensus on how things will play out with GME? I've read a good amount of the DD on reddit and while it's very thorough and well researched it seems like there's still an alternative where shorts will be able to slowly (yet still somewhat painfully) exit their positions without the massive squeeze. Maybe I just haven't done enough reading but a lot of this still seems to ride on a wing and a prayer.Fantastic post.

I knew a crash was coming.... the writing has been on the walls for some time. This just goes to prove it.

One thing that's impressive though is the apparent dedication. Is the squeeze more dependent on everyone continuing to buy and hold more than anything? If so that's pretty fascinating. Like a deranged MLM scheme that actually works the way you were told it would and everyone gets rich.

CloudNull

Banned

That is the thing about this.... no one knows how it plays out.I know you're following the meme stocks but what's the general consensus on how things will play out with GME? I've read a good amount of the DD on reddit and while it's very thorough and well researched it seems like there's still an alternative where shorts will be able to slowly (yet still somewhat painfully) exit their positions without the massive squeeze. Maybe I just haven't done enough reading but a lot of this still seems to ride on a wing and a prayer.

One thing that's impressive though is the apparent dedication. Is the squeeze more dependent on everyone continuing to buy and hold more than anything? If so that's pretty fascinating. Like a deranged MLM scheme that actually works the way you were told it would and everyone gets rich.

The DD on AMC and GME all makes sense statistically but there's seems to be a lot of illegality that is not being prosecuted. The fact that naked shorts are being openly discussed is a win but the fact that GME hasn't mooned 6 months later makes me think that no one really knows the timeline on this.

I am in the boat that hedge funds time is coming but they are suppressing the squeeze as long as possible. There are rumors that they are diversifying their portfolio by buying up all the houses like Block Rock to weather the looming crash. If we entertain this idea, it does come off as a much more logical explanation to all the houses being bought, than many other..... conspiratorial ideas that try to explain what is happening.

I am ride or die on this whole thing. Either the memes stocks moon or I hold forever taking a loss. All my money in memes stock is money that I can afford to loose.

HoodWinked

Member

my bag holds are finally going back to even.

VIAC actually up

MU back to positive

QQQJ only down -$38

PLTR finally positive +$14

VIAC actually up

MU back to positive

QQQJ only down -$38

PLTR finally positive +$14

HoodWinked

Member

I'm looking at Sofi and Plby

both are down from their highs

both are down from their highs

KingdomHeartsFan

Member

I bought up Sofi, was watching it like a hawk because I knew the lock up was ending and bought close to the bottom. I heard there's another lock up ending in a month so I'm considering if I should dump in a week or so and rebuy or just hold through it.I'm looking at Sofi and Plby

both are down from their highs

Last edited:

HoodWinked

Member

Ya that's probably a good thing to lookout for.I bought up Sofi, was watching it like a hawk because I knew the lock up was ending and bought close to the bottom. I heard there's another lock up ending in a month so I'm considering if I should dump in a week or so and rebuy or just hold through it.

I bought in at 19.12 so up just barely.

update: damn now i'm red

Last edited:

godhandiscen

There are millions of whiny 5-year olds on Earth, and I AM THEIR KING.

I bought more Google shares today. My old thesis with Google was that Stadia or Waymo or some Google X breakthrough was going to propel Google forward for the next 10 years, but then today as the company I work for (also in the ads industry) hit another revenue milestone, I figured, “fuck it, why not” and jumped the gun.

I hate Google, but they have made >40% return of my investment in the past 3 years.

People continue doubling down in their addiction to screens which means companies like the one I work for or Google have a greater opportunity to serve ads.

I hate Google, but they have made >40% return of my investment in the past 3 years.

People continue doubling down in their addiction to screens which means companies like the one I work for or Google have a greater opportunity to serve ads.

Average Screen Time Statistics For 2024

Do you love screens? The screen time stats in this article point out why you should spend less time on your Smartphone and your laptop.

elitecontentmarketer.com

Last edited:

AmuroChan

Member

anybody know anything about DIDI? good buy?

I'm keeping an eye on them. They're the Chinese Uber.

DarkestHour

Banned

noanybody know anything about DIDI? good buy?

crazepharmacist

Member

SONY up 3.46% today. Am I reading right that their P/E ratio is only 11.69?

I have 1500 shares of Sofi. I bought in when it was IPOE. Holding for long term.I'm looking at Sofi and Plby

both are down from their highs

AmuroChan

Member

SONY up 3.46% today. Am I reading right that their P/E ratio is only 11.69?

Yes, they're still in the undervalued category.

dem

Member

What's the deal with Amazon?

I'm guessing it has to do with Microsoft's JEDI Pentagon contract being cancelled.

Amazon has another chance to get in on that govt money

Last edited:

godhandiscen

There are millions of whiny 5-year olds on Earth, and I AM THEIR KING.

Yes, it is this. The contract is worth 10Bn, and Microsoft won it during the Trump administration.I'm guessing it has to do with Microsoft's JEDI Pentagon contract being cancelled.

Amazon has another chance to get in on that govt money

Amazon cried foul saying that the White House had influenced the bid decision; Trump isn’t fond of Amazon due to the fact Bezoz owns the Washington Post and other media that ran campaigns against the Republican Party.

An investigation was conducted that found no interference from the White House.

Nevertheless, with Trump gone, the contract was magically rescinded and Amazon and Microsoft have top bid again.

Weird shit going on with our government to favor Amazon. However, Microsoft software used by the government was found to have been penetrated by hackers during the last year, so that’s perhaps an argument against Microsoft.

I invest in both, Amazon and Microsoft

zeorhymer

Member

Not really. Amazon is salty that SpaceX won the contract for NASA instead of Blue Origin. This is probably a way to muscle back in with the Feds by lining up various senator's pockets.Weird shit going on with our government to favor Amazon. However, Microsoft software used by the government was found to have been penetrated by hackers during the last year, so that’s perhaps an argument against Microsoft.

godhandiscen

There are millions of whiny 5-year olds on Earth, and I AM THEIR KING.

I agree with your line of thinking, but I also feel Microsoft should be liable for the hacks experienced last year on their software to some degree. Not that they should have lost the JEDI contract though.Not really. Amazon is salty that SpaceX won the contract for NASA instead of Blue Origin. This is probably a way to muscle back in with the Feds by lining up various senator's pockets.

Last edited:

HawksWinStanley

Member

10 year Treasury yield dropped again? Have we already seen the majority of the recovery? Seemed kind of soon to me, kind of worrying.

HoodWinked

Member

two straight days of being reamed

KingdomHeartsFan

Member

Small and medium cap companies are getting hammered, there's a huge run to large cap companies. The small companies I'm invested in are all expected to kill it in their upcoming earnings in a month so I'm not worried about this temporary fall but its weird to see this.

CrankyJay™

Member

Stonks aren't looking good lately.

Ellery

Member

Stonks aren't looking good lately.

What is? And what would be the play against stocks from falling?

StreetsofBeige

Gold Member

Same boat guys. After hitting my all time high a week or two ago, I've sunk about 3% since. Just a steady trickle down most days. No giant drops.

GHG

Gold Member

What is? And what would be the play against stocks from falling?

Sell covered calls (although it might be a bit late for that now to get the best premiums), buy protective puts, or if you're ballsy simply shorting the market.

You can take out "indirect" short positions by taking up positions in inverse ETF's.

CrankyJay™

Member

Same boat guys. After hitting my all time high a week or two ago, I've sunk about 3% since. Just a steady trickle down most days. No giant drops.

Hit ATH last week in my cash account, which was about $56k, down to $53k now and I haven't really been doing any trading for the past 2 months. Just leaving it alone. I have a little over $5k sitting in cash to invest if there are any phenomenal drops.

Ellery

Member

Sell covered calls (although it might be a bit late for that now to get the best premiums), buy protective puts, or if you're ballsy simply shorting the market.

You can take out "indirect" short positions by taking up positions in inverse ETF's.

That sounds good

Can't do options here. They are much more amazing in the US.

StreetsofBeige

Gold Member

Dead red for me except my Hydro One is up a whopping 2 cents.Just a sea of red everywhere you look today.

HoodWinked

Member

this is just getting comical like clockwork my 401k contribution again buying the top again on another high day.

StreetsofBeige

Gold Member

Yesterday, my portfolio rebounded and ended up only down literally $3! Today was a nice jump. So tempted to jump back in. I'm sitting at 50% cash.

Taxexemption

Member

this is just getting comical like clockwork my 401k contribution again buying the top again on another high day.

Lately I'm just going into dividend ETF's because I view the prices on most of what I want to be high. I have an automatic transfer that just went through, on Monday I'm probably going into XLU, a utility ETF, and POTX. XLU for the dividend, and because I view utilities as relatively safe. As for POTX, I'll explain my thinking in the following paragraph.

POTX is a cannabis ETF. This is a long play for me, I am of the belief that legalization will happen on the federal level within the next decade, and that either right before or when it does there will be a huge rush into cannabis stocks, and that their prices will be driven up to completely ridiculous levels for a short period of time. This is speculation, it's what I expect to happen, but who knows. I've been wrong about plenty. It's entirely possible that there will be a cultural shift, or that this is an issue that congress chooses not to deal with until a lot farther into the future. If legalization is more than a decade off, I wouldn't be surprised if this turned out to be a poor investment compared to my other investments.

StreetsofBeige

Gold Member

Thread has died off. So has my portfolio. Been a very boring 2-3 weeks. About 2% off my high. Roughly 60% cash waiting to spend.