EEDAR's founder Geoffrey Zatkin did the annual EEDAR data presentation on the games industry and consumer habits. Here are the notes from GameDev.net (no articles yet)

Images from Twitter

Trends

- Gamers are entertainment consumers on every possible medium

- 65% of US population are game players

- Who games?

- 48% of population in 2016

- Households on average have 2 consoles

Platforms

- Wii most popular platform over 100m units

- 50M PS4s

- 85m Xbox 360 and PS3

- 3DS 65M

- Core consoles in current generation (8th) - (w/out Nintendo) - are outselling 7th generation

- There is a shift from a balanced portfolio of genres to a more core focused portfolio of shooter and action genres. Casual genres slowing trend.

Genres

- Mobile most popular: Puzzle, Arcade, Strategy

- Console most popular: Action, RPG, Shooter

Mobile

- Most gamers play games on a variety of devices

- Different games depending on device available or time

- Most people upgrade phones 18-24 months

- Average smartphone 6 months to 1 year old

- Android fragmentation making market sizing difficult - variety of device power and not all games can run on all devices

- North American mobile market is maturing

- Fewer new device owners entering market

- Gaming population increasing faster than hardware adoption

- 155 million mobile gamers in 2016

Large percent of mobile gamers owning more than one device generate revenue

- 51% own more than one mobile device

- 60% of revenue

Virtual Reality

- More VR units in mobile

- High end VR (PSVR, Oculus, Vive) making most revenue

- Critical mass of VR hardware is building - enough to begin having a profitable VR ecosystem

Demographics

- Average age of gamers in US 2016: 35

- Age distribution:

- ​Less than 18 yrs old - 27%

- 18-35 yrs old - 29%

- 36-49 yrs old - 18%

- 50+ yrs old - 26%

- Mobile market payers also shifting older y/o/y - 37 yrs old 2016 vs 32 2014

- 60/40 ratio of male/female gamers

- More women playing games longer than people think

- Men tend to play PC (64%), Women tend to play mobile (55%)

- 55% women pay in mobile

Distribution

- Barriers to create games of quality have never been lower, yet retail console, handheld, PC title releases in 2016 lowest its been

- But when we consider Retail and Digital distribution - most ever.

- 6500 games released for console, PC, handheld

- 4600 games released on Steam in 2016

- 2015 - 3400 games

- 2014 - 1500 games

- More games on Steam last year than the entire console, handheld, etc.

- No more physical-only released games in consoles - digital distribution always included

- Number of games released by publishers has decreased

- Massive consolidation in top tier publishers, more stringent, less risky

- 50% drop in games released by publishers since 2012

Financials

- $16.5 billion industry in US

- ~1/3 of revenue coming from mobile

- Mobile payers defined as less than $100 per year spent average of $43 in 2016

- Heavy payers defined as over $100 spent average of $310 in 2016

- Population of heavy payers has increased

- More people in category, but less per average

- 7% of mobile gamer population brings in 55% of mobile revenue

- Heavy correlation between people who play and people who pay

- Top 50% of games generate 99% of revenue

- Top 10% of games generate 60% revenue

- Top 2% of games generate 30% revenue

- 12% of retail titles have generated 75% of retail revenue since 2012

Discoverability and Behavior

- Average review score in industry is 69 - below 80 which is the cutoff in consumers for good enough game

- Most games receive a score in 70s

- Advertising matters. Without good marketing you may do well but never as well as you could and usually substantially less.

- Direct correlation between review scores and sales.

- Those who market get ~2x in sales. Discovery is the biggest issue for developers.

- Top factors affecting discovery

- ads in apps, games, social media

- social sources

- ads on website

- storefront charts/featured

- Price and Genre key factors affecting engagement

- User reviews, theme/graphics, recommendations are top factors. Storefront elements (featured, top spot, trailers) bottom factors.

- Players leaving the game - key factor was general loss of interest/boring

- Might leave for a better user experience.

- Perspective is very important in your game

- Top factors: had to pay real money to progress/complete, game was not what expected.

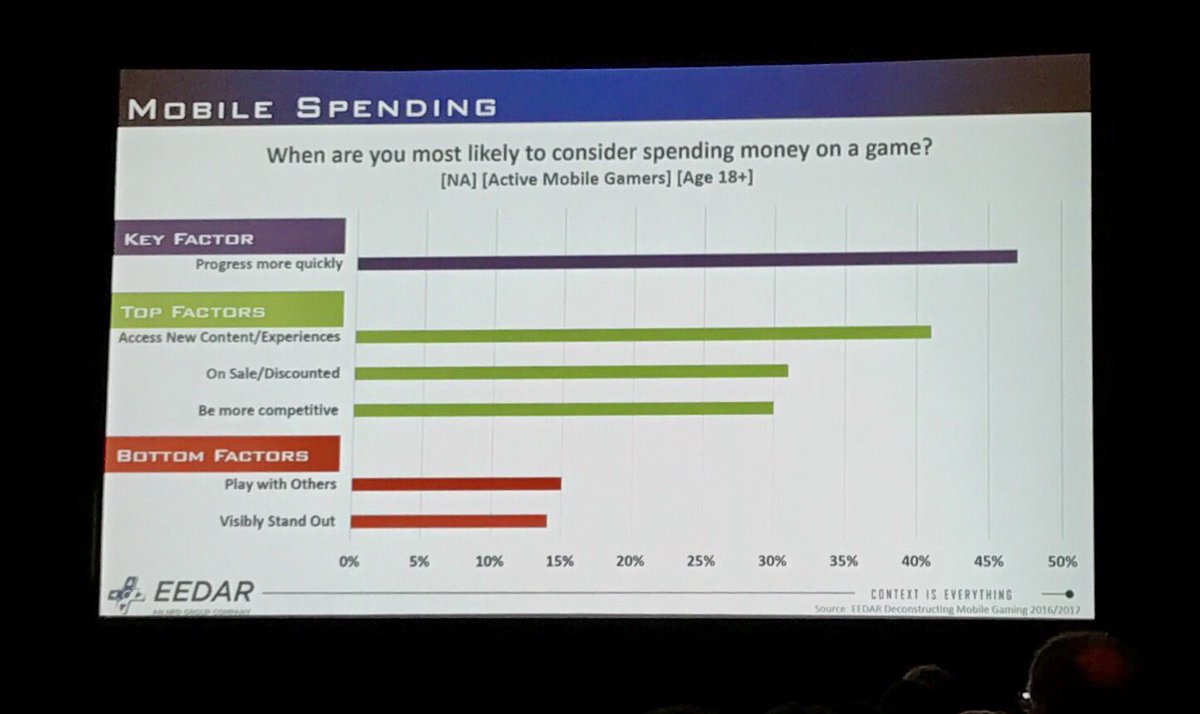

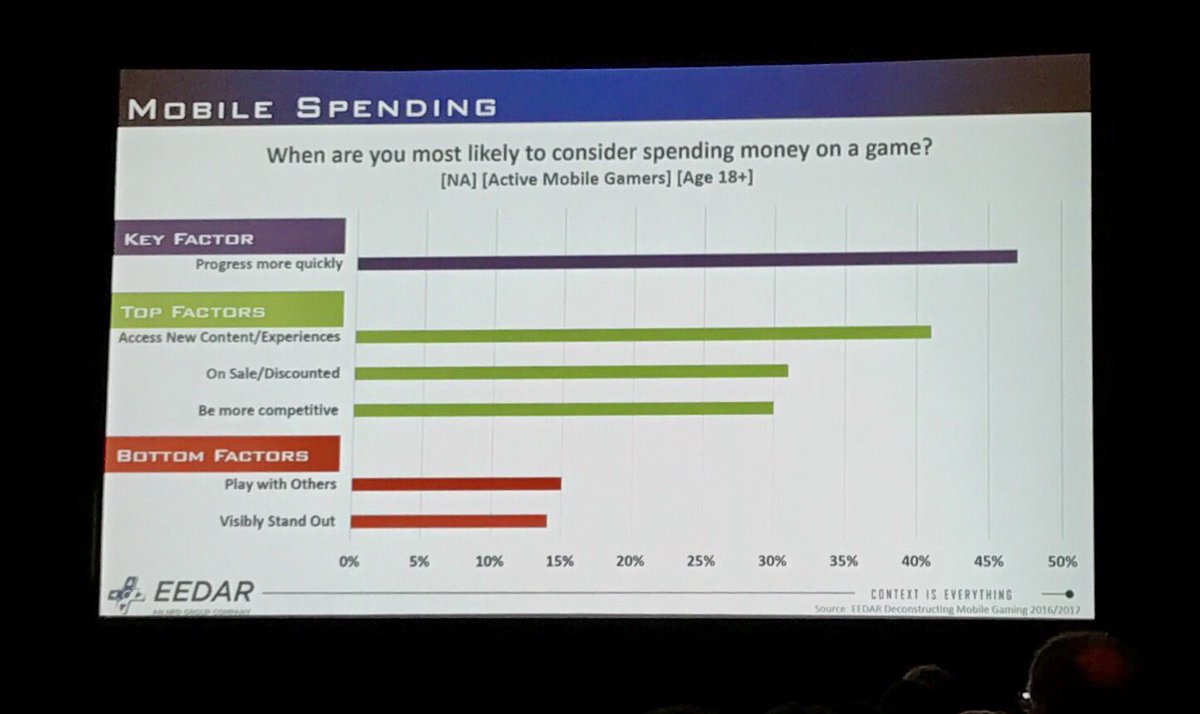

- Western plays are okay with spending money to progress quickly despite stigma in paying to play

- Top 5 most played genres

- brain puzzle

- matching puzzle

- skill and chance

- casino

Kickstarter

- 29,216 successfully funded projects

- $600 million to games

- $535m successful

- $53m unsuccessful

- $5.6m live dollars

- Some using kickstarter as a marketing opportunity or to engage commnity earlier

- ~1/3 successfully funded

- This year so far, 76 games > $1million. 3867 games $1k to 10k, most popular funding level

- Kickstarter getting more difficult, especially as more finished games enter

- 67% of unsuccessful get < 20% funded

- More than half the games on kickstarter got no significant money

Pokemon Go

Virality - more than 1/3 heard of game from friend. App Store 5%

Images from Twitter