Draugoth

Gold Member

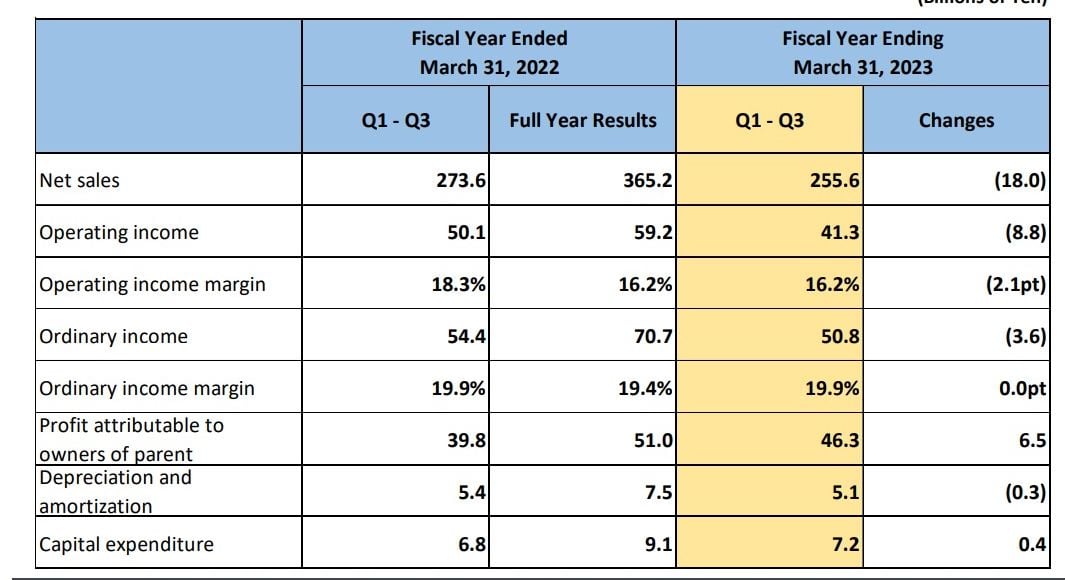

Today Square Enix announced its financial results for the first nine months of the fiscal year, related to the period between April and December 2022.

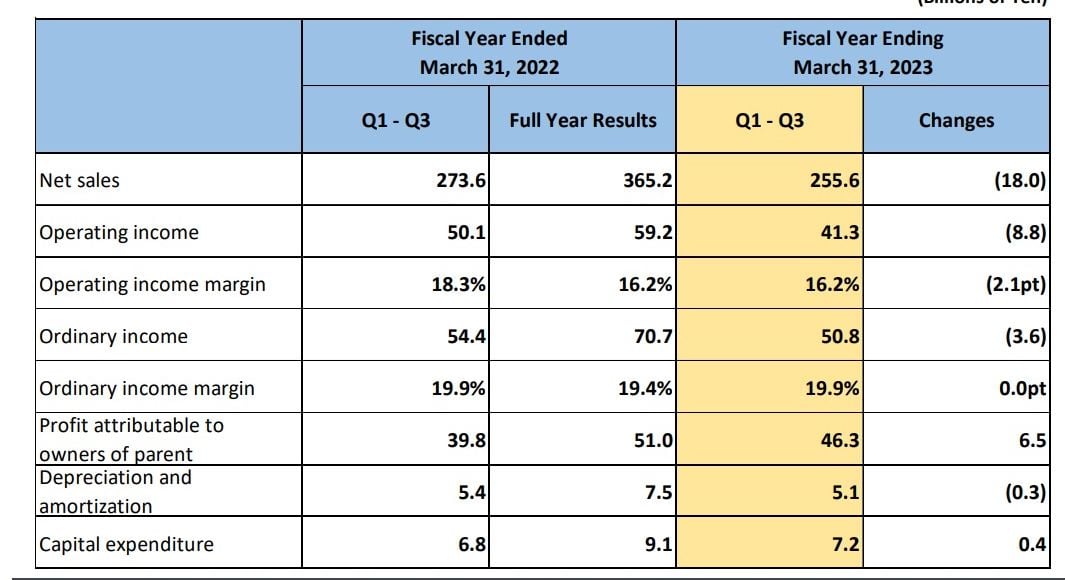

Sales were 255,616 million yen, down 6.6% year-on-year. Operating income was 41,315 million yen, down 17.6% year-on-year.

In the table below, you'll notice that the profit attributable to owners of parent is actually positive year-on-year. That's due to the 9,500 million gained from the sale of Crystal Dynamics, Eidos Montreal and more to Embracer.

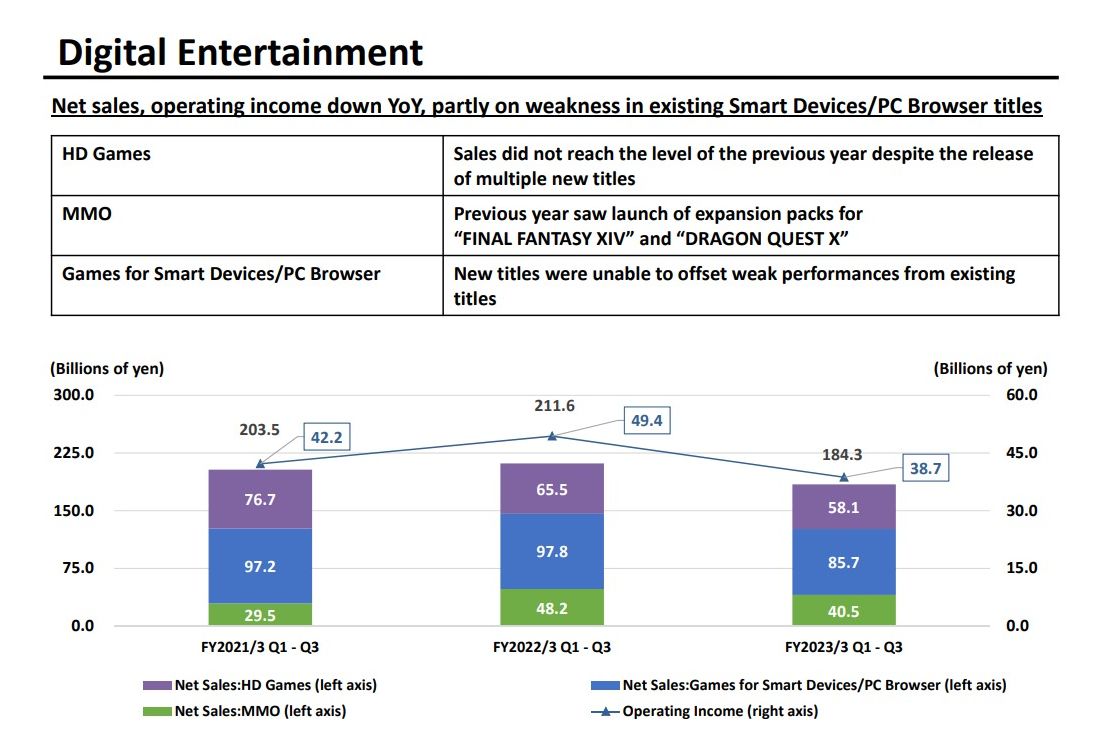

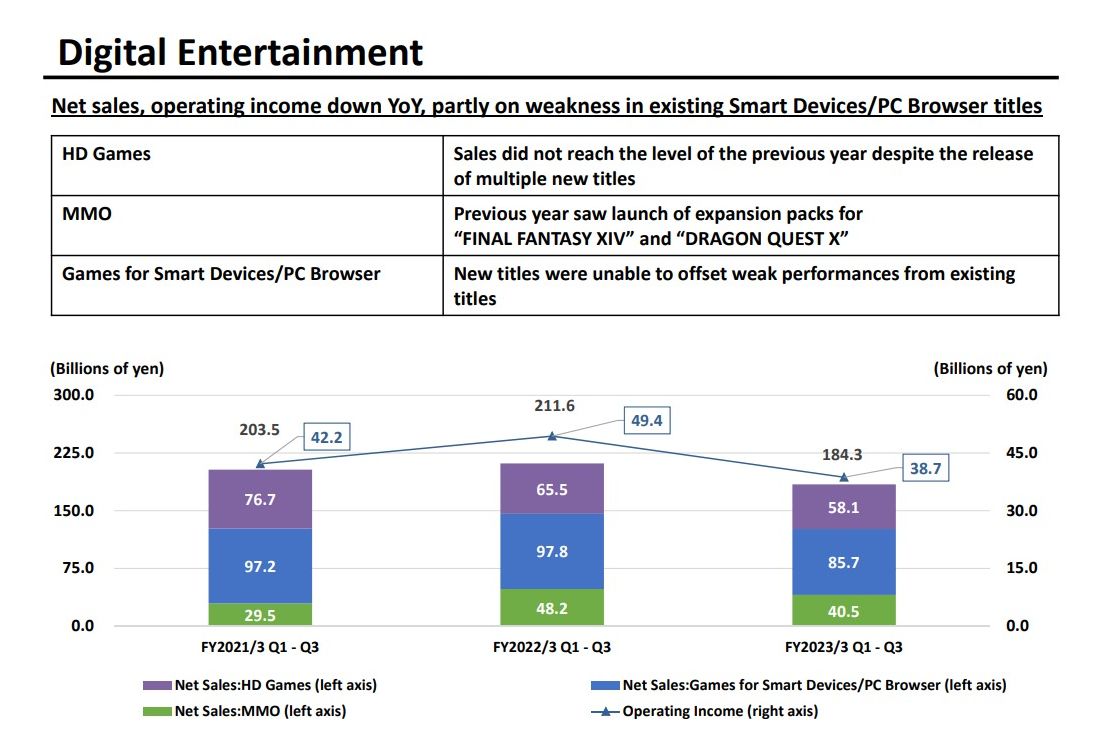

Looking at the Digital Entertainment unit, which includes video games, net sales were 184,380 million, down 12.9% year-on-year, while operating income was ¥38,735 million, down 21.6% year-on-year.

Sales of HD games (non-GAAS games for consoles) failed to reach the level of the previous year despite the launch of multiple new games. During the previous fiscal year, Square Enix launched titles like NieR Replicant ver. 1.22474487139..., Marvel’s Guardians of the Galaxy, and Outriders, and this year's games simply weren't able to generate the same results.

A drop in the MMO segment was to be expected. As well as Final Fantasy XIV may be doing, it's hard to compete against the quarter (Q3 in the previous fiscal year) in which Square Enix released the highly acclaimed and extremely profitable Endwalker expansion.

Smartphone and browser games also suffered from the weak performance of existing titles, contributing significantly to the decline in sales.

That being said, we hear that Square Enix has "multiple new titles planned, including titles featuring new IP" for the HD Games segment. While no expansions are planned for the MMO segment in the short term, the company "will focus on retaining users through a variety of operational initiatives." As for browser and smartphone games, the company has "additional titles slated for launch in Q4 and beyond."

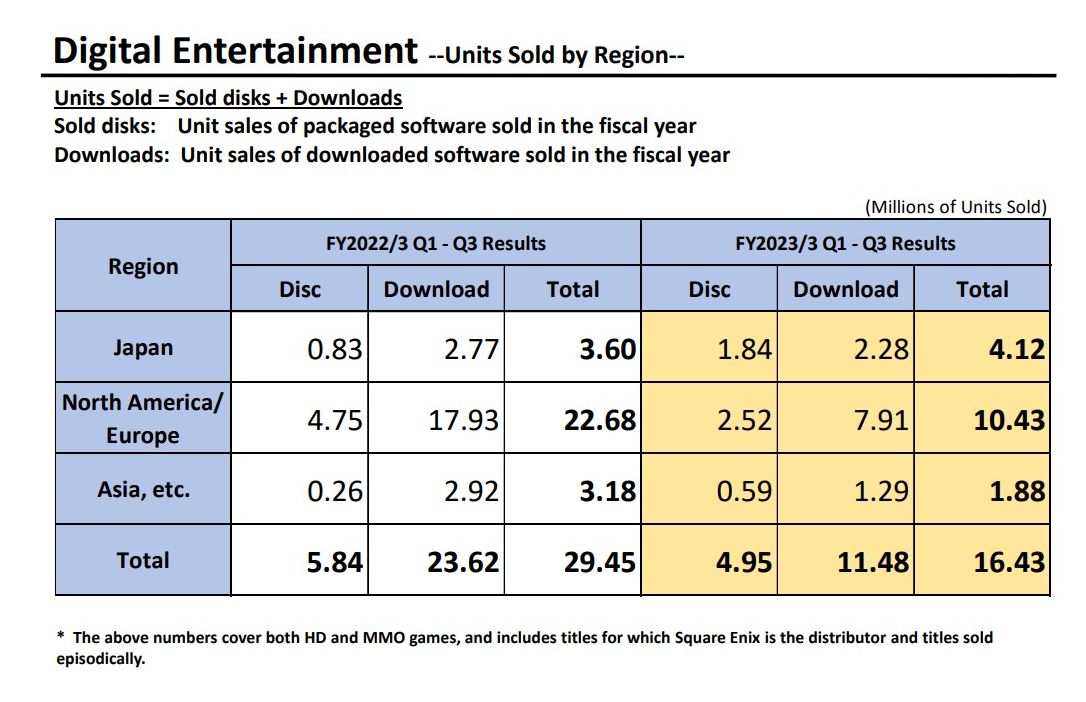

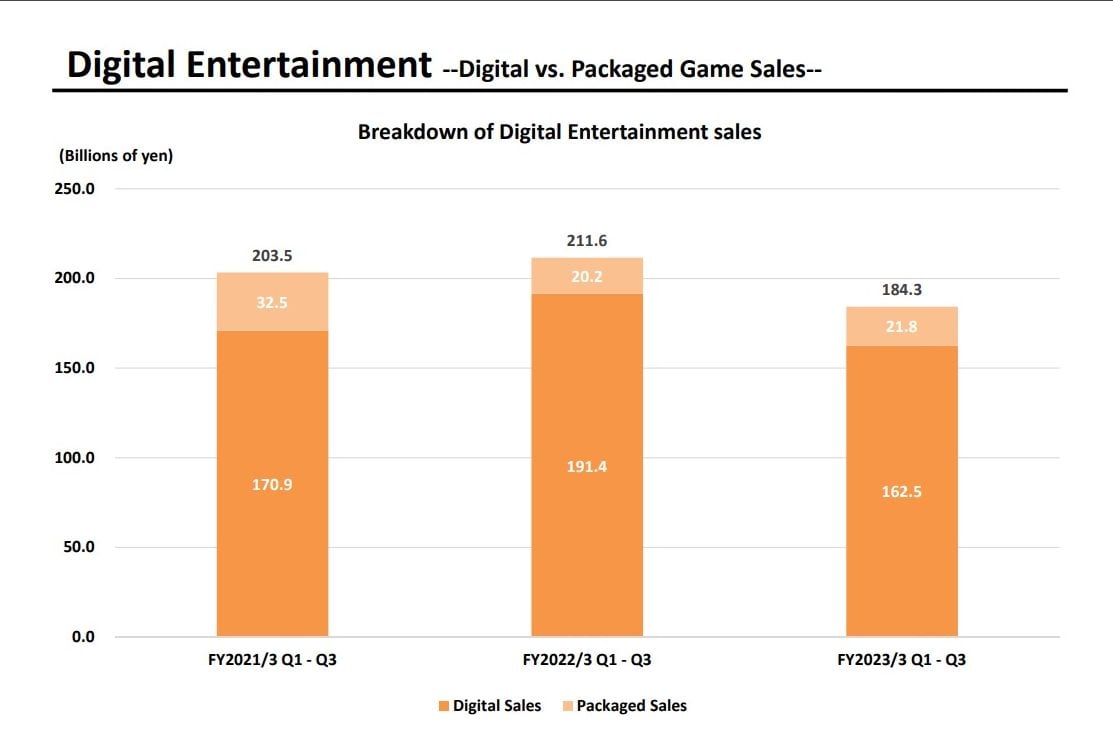

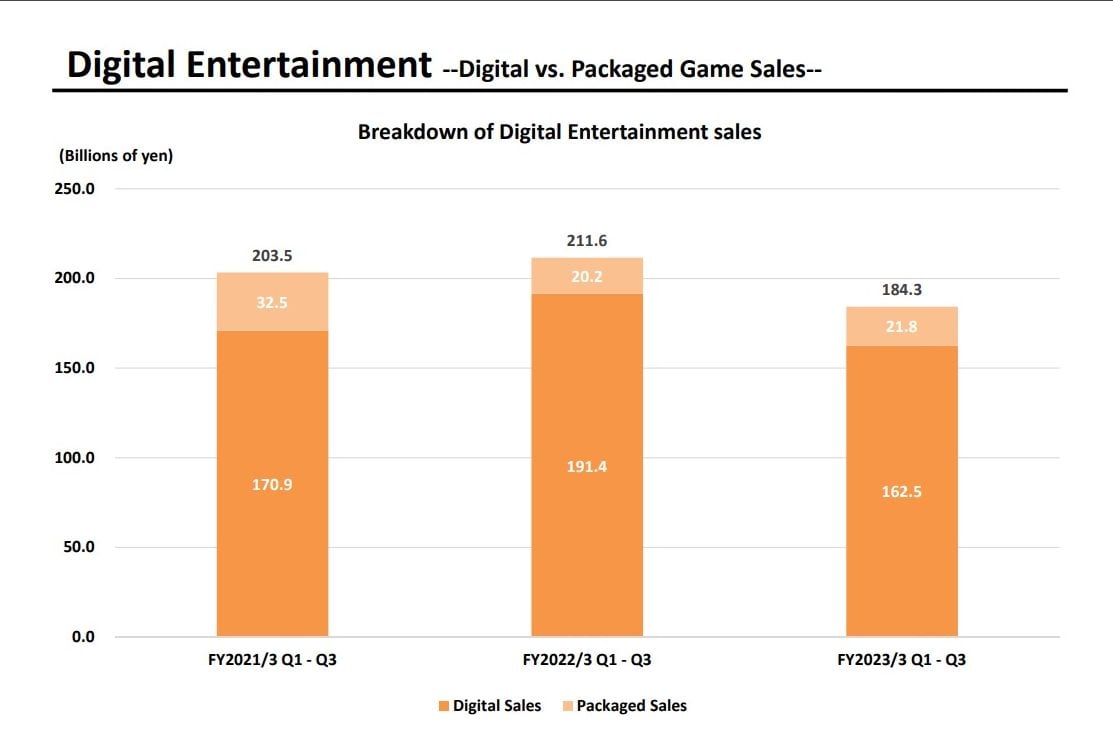

Below you can check out the ratio between digital and packaged sales, which is massively in favor of the former. That's unsurprising since all sales for subscriptions and smartphone games are digital.

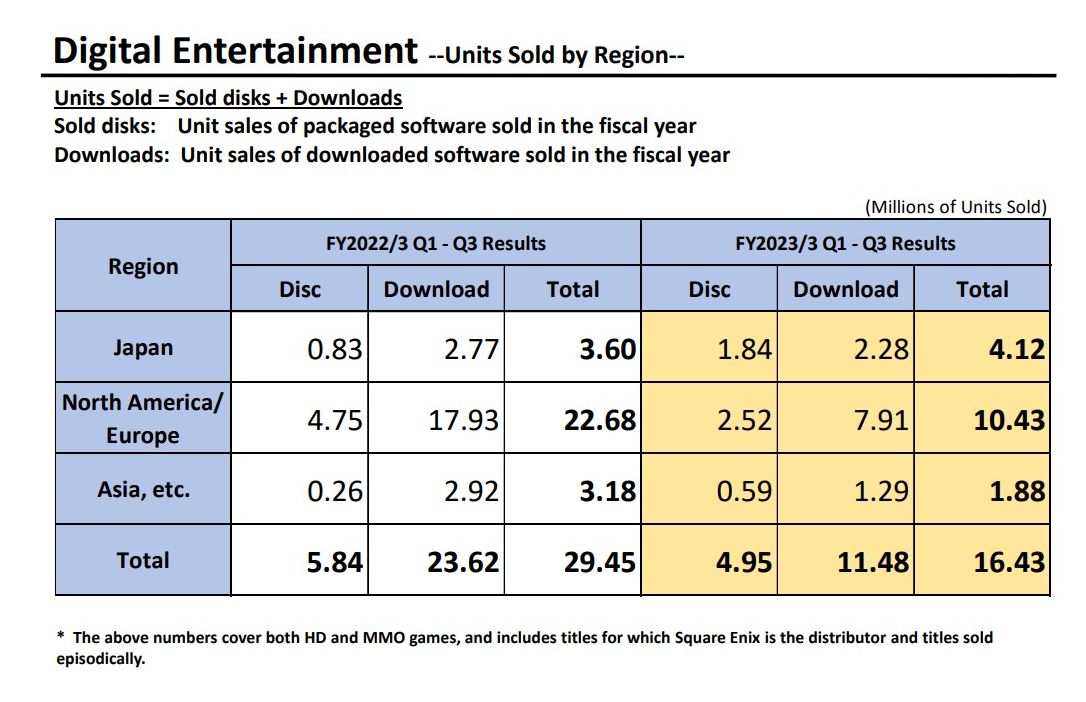

Last, but not least, we see a breakdown of unit sales by region groups, with North America and Europe taking the lion's share.

Sales were 255,616 million yen, down 6.6% year-on-year. Operating income was 41,315 million yen, down 17.6% year-on-year.

In the table below, you'll notice that the profit attributable to owners of parent is actually positive year-on-year. That's due to the 9,500 million gained from the sale of Crystal Dynamics, Eidos Montreal and more to Embracer.

Looking at the Digital Entertainment unit, which includes video games, net sales were 184,380 million, down 12.9% year-on-year, while operating income was ¥38,735 million, down 21.6% year-on-year.

Sales of HD games (non-GAAS games for consoles) failed to reach the level of the previous year despite the launch of multiple new games. During the previous fiscal year, Square Enix launched titles like NieR Replicant ver. 1.22474487139..., Marvel’s Guardians of the Galaxy, and Outriders, and this year's games simply weren't able to generate the same results.

A drop in the MMO segment was to be expected. As well as Final Fantasy XIV may be doing, it's hard to compete against the quarter (Q3 in the previous fiscal year) in which Square Enix released the highly acclaimed and extremely profitable Endwalker expansion.

Smartphone and browser games also suffered from the weak performance of existing titles, contributing significantly to the decline in sales.

That being said, we hear that Square Enix has "multiple new titles planned, including titles featuring new IP" for the HD Games segment. While no expansions are planned for the MMO segment in the short term, the company "will focus on retaining users through a variety of operational initiatives." As for browser and smartphone games, the company has "additional titles slated for launch in Q4 and beyond."

Below you can check out the ratio between digital and packaged sales, which is massively in favor of the former. That's unsurprising since all sales for subscriptions and smartphone games are digital.

Last, but not least, we see a breakdown of unit sales by region groups, with North America and Europe taking the lion's share.